delayed draw term loan commitment fee

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. The accounting treatment is determined by whether 1 the lender remains the same and 2 the.

Us Financing guide 34.

. Closing date and z 2 for the period after one. While the fee structure for DDTLs has always been a negotiated point and has varied based on the actual arrangements sponsorsborrowers and debt providers the migration of the DDTL tranche upmarket has put the spotlight on some of those economics. The closing date through one year following the.

Delayed-Draw Term Loan Facility Commitment Fees. The legal form of a modification transaction whether a legal exchange or a legal amendment is irrelevant for purposes of determining whether it is an accounting modification or extinguishment. Each Lender agrees severally but not jointly upon the terms and subject to the conditions of this.

A ticking fee accumulates on the portion of the undrawn loan until you either use the loan entirely terminate it or the period of commitment expires. Total DDTL commitments ie 1 million pay-. In addition to a ticking fee you may be on the hook for an upfront fee when you close on your loan.

DDTLs carry ticking fees akin to commitment fees which are payable during the commitment period on the. The Cost of Bespoke Finance. Unlike a traditional term loan that is provided in a lump sum a DDTL is released at predetermined intervals.

GEF GEFB a global leader in industrial packaging products and services announced today that it has entered into a new 225 million delayed draw term loan with a syndicate of Farm Credit institutions led by CoBank with a maturity date in 2026. The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged buyouts LBOs and other private equity transactions and critical points of negotiation including conditions precedent to making draws ticking fees loan term and fronting arrangements in. An accordion feature is a type of option that a company can buy that gives it the right to increase its line of credit.

Like revolvers they have commitment fees around 1 and in addition they carry ticking fees which charge the borrower additional points the. September 29 2020. Able on the closing date on a nonrefundable basis.

Superior Energy Services Inc. Year following the closing date. DELAWARE Ohio Nov.

When a reporting entity enters into a delayed draw debt agreement it pays a commitment fee to the lender in exchange for access to capital over the contractual term. Delayed-Draw Term Loan Commitment Letter. The payment of this fee is not absolute.

16 2020 PRNewswire -- Greif Inc. Delayed Draw Term Loan B Commitment and Fees. The Borrower shall pay a commitment fee of 50 of the interest rate margin with respect to LIBOR borrowings per.

DDTLs were used in bespoke arrangements. Business Finance - Loan Agreements. If you take out a DDTL youll be responsible for a ticking fee.

For example the involved parties can agree upon intervals such as every three six or nine months. A special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. This pay-for-delay compensation may be important because cash deals are nearly universally struck at a fixed cash price paid at closing whenever that happens.

Although ticking fees are most often reluctantly conceded by buyers a. PRIVILEGED AND CONFIDENTIAL. USA February 13 2018.

A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount. DDTLs carry ticking fees akin to commitment fees which are payable during the commitment period on the unused portion of. The commitment fee is typically lower than the interest rate that is charged on the drawn portion of the loans.

The Borrower shall pay a commitment fee of 50 of the interest rate margin with respect to LIBOR borrowings per annum in each case on the daily average unused portion of the Delayed-Draw Term Loan Facility payable quarterly in arrears on the last day of each fiscal quarter commencing with the first full fiscal quarter ending after the Closing Date with the. In this case the ticking fee is paid pursuant to a commitment agreement signed by the prospective lender rather than the credit agreement. A fee paid by a borrower on the unused portion of its revolving credit loans or delayed-draw term loans to compensate the lenders for their commitment to make the funds available to the borrower for a certain period of time.

2 a 1 Closing Fee calculated as a percentage of. This CLE course will discuss the terms and structuring of delayed draw term loans. While the fee structure for DDTLs has always been a negotiated point and has varied based on the actual arrangements sponsorsborrowers and debt providers the migration of the DDTL tranche upmarket has put the spotlight on some of those economics.

SUBJECT TO FRE 408. Delayed Draw Term Loan. DDTLs provide enhanced flexibility for longer-term capital.

EX-102 3 d90605dex102htm EX-102 EX-102. That is the fees are paid whether or not the funds are ever drawn down.

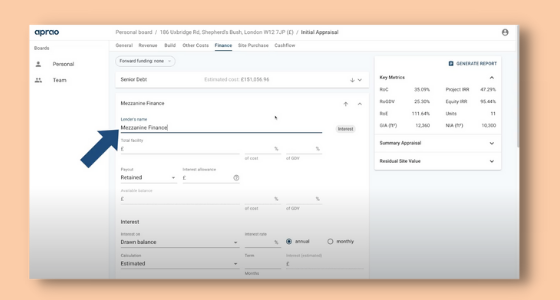

What Is Mezzanine Finance And How Does It Work

Pdf The Importance Of Long Term Financing By Banks Advantages And Future Challenges

Delayed Draw Term Loans Financial Edge

Financing Fees Deferred Capitalized Amortized

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Lbo Model Test Practice Interview Example Excel Template

Financing Fees Deferred Capitalized Amortized

A First Time Buyers Guide To Understanding The Construction Loan Process Newhomesource Construction Loans Home Construction Home Improvement Loans

Sponsors Holster Revolvers For Delayed Draw Loans Churchill Asset Management

How To Calculate An Interest Reserve For A Construction Loan Propertymetrics

Jason Bross Founding Partner Chief Operating Officer Chief Compliance Officer Latitude20 Capital Partners Llc Linkedin

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Leveraged Buyout Modeling Standard 1 Hour Lbo Test Excel Template

Leveraged Buyout Model Advanced Lbo Test Training Excel Template